When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Revenue vs. Profit: Main Characteristics and Differences

Revenue and profit are entirely different financial terms, but are commonly conflated by investors. Let’s examine each financial concept in detail.

QUOTE

Remind people that profit is the difference between revenue and expense.

Big ideas

- Revenue, also known as sales or turnover, is the total income generated by the sale of goods or services. Profit, or net profit, is the balance left after all expenses have been paid.

- A company can generate a large revenue but can have a negative net profit. Both are recorded on a company’s income statement, but in different sections.

- There are many types of revenue, but total revenue is the most relevant. There are only three main types of profit - net, gross, and operating.

What is revenue?

DEFINITION

Revenue is simply the total amount of income generated from sales/services.

A software company might have made £1,000,000 in sales of a SaaS product, by selling 100,000 units at a price of £10 each. Net revenue does not contain company expenses in its calculation.

Revenue is referred to as the top line, as this is where it appears on the income statement. In contrast, profit is referred to as the bottom line, as this is where it appears on the income statement. So you start at revenue and end at profit.

Revenue can be further divided into gross revenue or net revenue. The difference is that gross revenue takes into account pricing discounts and returns, giving a more accurate representation than net revenue.

Revenue can be further divided into gross revenue or net revenue. The difference is that gross revenue takes into account pricing discounts and returns, giving a more accurate representation than net revenue.

Types of revenue

Aside from gross and net revenue, there are many different categories.

Average revenue per unit/user (ARPU)

Average revenue per unit/user (ARPU) measures the revenue generated per user or unit. It is useful for businesses like telecoms, where it helps gauge the average income from each customer. ARPU is calculated by dividing the total revenue by the number of users or units over a specific period.

Monthly recurring revenue (MRR)

Monthly recurring revenue (MRR) represents the predictable income a company expects every month from subscription services. MRR is crucial for businesses with subscription models, such as SaaS companies, as it indicates the stability and growth of their revenue base.

Annual recurring revenue (ARR)

Similar to MRR, Annual recurring revenue (ARR) measures the yearly subscription revenue expected from customers. It provides a long-term view of revenue stability and growth, making it essential for planning and forecasting in subscription-based businesses.

Non-operating revenue

Non-operating revenue includes income not related to the core business operations. Examples are interest earned on investments, asset sales, or dividends from other companies. Non-operating revenue helps understand a company's overall financial health beyond its primary activities.

Revenue can also be divided into product/sector types, as opposed to time or user. This includes:

- Sales revenue

- Interest revenue

- Royalty revenue

- Commission revenue

- Service revenue

- Dividend revenue

- Rental revenue

- Franchise revenue

- Advertising revenue

- Licensing revenue

Plus, what constitutes revenue depends on the industry or sector. Your salary is a form of revenue to you, in terms of personal finance - but it is a liability for your employer. Similarly, the sale of a product is a form of revenue for a company but a liability for the consumer.

Revenue examples and calculation

Sales revenue is the income a business earns from selling goods or services. For instance, a retail store in the UK might sell clothing and accessories. If the store sells £50,000 worth of products in a month, that amount is its sales revenue for that period.

FORMULA

Revenue = Number of Units Sold x Average Price

or

Revenue = Number of Customers x Average Price of Services

or

Revenue = Number of Customers x Average Price of Services

Sales revenue is a primary indicator of business performance, showing how well the company’s products or services are received by the market. It directly affects the profit margins and overall financial health of the business.

Another example is subscription revenue. This comes from customers who pay regularly for access to a service or product.

Another example is subscription revenue. This comes from customers who pay regularly for access to a service or product.

EXAMPLE

A UK-based software company might offer a subscription service for £20 per month. If the company has 1,000 subscribers, it generates £20,000 in monthly subscription revenue.

This type of revenue is particularly valuable because it provides a predictable and steady income stream. Subscription models are common in industries like software, media, and telecommunications, where businesses offer ongoing access to their services or products in exchange for regular payments.

Both sales and subscription revenues are crucial for business sustainability. They not only reflect the business's ability to attract and retain customers but also play a significant role in financial planning and growth strategies. These are just two examples of the many different types of revenue.

Both sales and subscription revenues are crucial for business sustainability. They not only reflect the business's ability to attract and retain customers but also play a significant role in financial planning and growth strategies. These are just two examples of the many different types of revenue.

Factors affecting revenue

The big one is, of course, pricing. Raising the price of products is the easiest way to increase revenue with a similar quantity of purchases. However, the problem is that customers might not make purchases beyond a certain price point.

This is why, as you have probably noticed, companies can get very creative in terms of how they offer pricing and subscription models to customers. The most important thing is that a customer perceives they are getting a bargain or price reduction. Whether they actually are, is an entirely different story.

Of course, there are many other factors that come into play. External competition can easily result in reduced sales, as would a poor economic climate. The quality of the product or service provided might be reduced for some reason. And poor publicity can also really hurt a company, founded or not.

This is why, as you have probably noticed, companies can get very creative in terms of how they offer pricing and subscription models to customers. The most important thing is that a customer perceives they are getting a bargain or price reduction. Whether they actually are, is an entirely different story.

Of course, there are many other factors that come into play. External competition can easily result in reduced sales, as would a poor economic climate. The quality of the product or service provided might be reduced for some reason. And poor publicity can also really hurt a company, founded or not.

The revenue recognition principle

The revenue recognition principle is a key accounting rule that dictates when revenue should be recorded. According to this principle, revenue should be recognised when it is earned, not necessarily when the cash is received. This means that revenue is recorded when a product or service is delivered, and the earnings process is complete, even if payment has not yet been made.

For example, if a company delivers a product in December but receives payment in January, the revenue should be recognised in December. This principle ensures that financial statements reflect the actual economic activities and performance of a company during a specific period.

It helps provide a clearer picture of a company's financial health and operational efficiency by aligning revenue with the period in which it was earned. This approach improves the accuracy of financial reporting and helps investors and analysts make better-informed decisions.

For example, if a company delivers a product in December but receives payment in January, the revenue should be recognised in December. This principle ensures that financial statements reflect the actual economic activities and performance of a company during a specific period.

It helps provide a clearer picture of a company's financial health and operational efficiency by aligning revenue with the period in which it was earned. This approach improves the accuracy of financial reporting and helps investors and analysts make better-informed decisions.

What is profit?

For any investor, one of the first things they want to know is a company’s profits, the bottom line. Regardless of what way you look at it, a company that has earned $1,000,000 in profit is 10x better than one that has earned $100,000 in a given year. After all, the goal of a business is to make money.

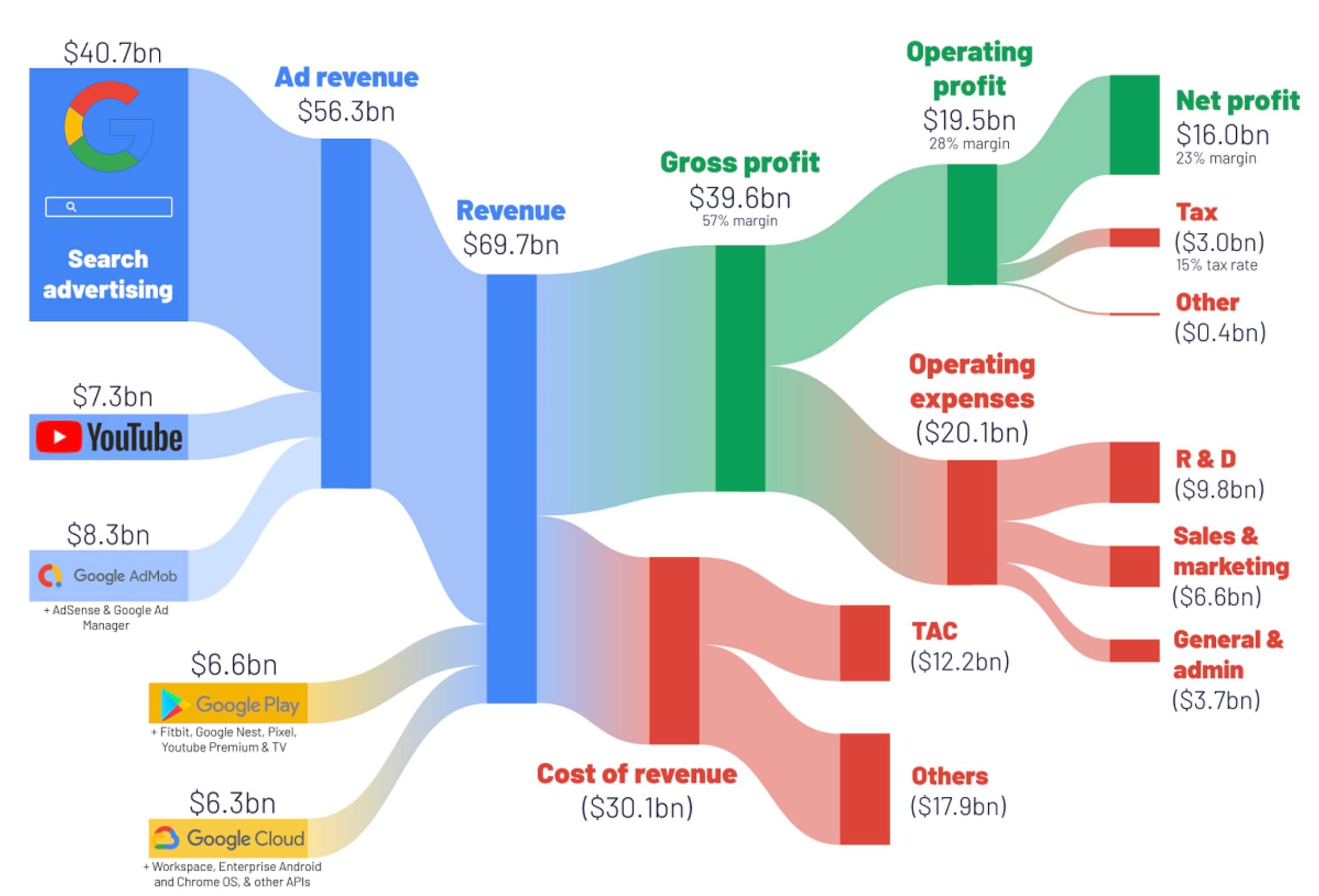

Alphabet Quarterly Income Statement - June 2022

Source: Visual Capitalist

Source: Visual CapitalistHowever, many investors also caution that it is useful to pay attention to cash flow as well as net profit. Otherwise, profit margins could turn south rather quickly. Cash flow is often referred to as the life blood of a company.

Types of profit

There are three main types of profit:

Net profit

Net profit represents the bottom line on a company's income statement. It represents the total earnings after all expenses have been deducted, including operating costs, interest, taxes, and one-time charges. This figure shows the company's ability to generate profit from its total revenue. This metric is crucial as it indicates the company's profitability after accounting for all costs.

Gross profit

Gross profit is the profit a company makes after deducting the costs associated with producing and selling its products, known as the cost of goods sold (COGS). It does not include other expenses such as operating costs, taxes, or interest. Gross profit is important for understanding the efficiency of production and pricing strategies.

Operating profit

Operating profit, also known as operating income, is the profit earned from a company's core business operations. It is calculated by deducting operating expenses, including wages, depreciation, and rent, from gross profit. This measure is significant as it reflects the company's ability to generate profit from its primary business activities before considering the effects of financing and investments.

Profit examples and calculation

FORMULA

Net Profit = Net Revenue - Cost of Goods Sold (COGS) - Operating Expenses - Interest Expenses - Taxes

or

Net Profit = Net Revenue - Total Expenses

or

Net Profit = Net Revenue - Total Expenses

EXAMPLE

Consider a company with total revenues of £1,000,000. To find the gross profit, subtract the cost of goods sold (COGS) from this figure. If COGS amounts to £400,000, the gross profit is £600,000.

Next, to determine operating profit, deduct operating expenses such as salaries, rent, and utilities from the gross profit. If operating expenses total £200,000, the operating profit would be £400,000.

Finally, to calculate net profit, subtract additional costs like interest and taxes from the operating profit. If interest expenses are £50,000 and taxes amount to £80,000, the net profit would be £270,000.

Next, to determine operating profit, deduct operating expenses such as salaries, rent, and utilities from the gross profit. If operating expenses total £200,000, the operating profit would be £400,000.

Finally, to calculate net profit, subtract additional costs like interest and taxes from the operating profit. If interest expenses are £50,000 and taxes amount to £80,000, the net profit would be £270,000.

In summary, gross profit reflects the company’s earnings from core operations, operating profit shows the profit after all operating costs, and net profit accounts for all expenses, including taxes and interest.

Factors affecting profit

Profit is affected by revenue. But it is also affected by factors that revenue is not concerned with - COGS, salaries, rent, taxes, interest, depreciation, etc. In other words, revenue can influence profit, but so can a variety of additional factors.

Anything that affects the business will ultimately be reflected in the bottom line of net profit. There isn't anything business-related that won’t affect net profit. This is because net profit is the result of everything that goes into the business - it is what you are left with after everything has been accounted for.

Anything that affects the business will ultimately be reflected in the bottom line of net profit. There isn't anything business-related that won’t affect net profit. This is because net profit is the result of everything that goes into the business - it is what you are left with after everything has been accounted for.

Key differences between revenue and profit

Simply put, revenue is the total income from sales while net profit is what is left when all other expenses have been accounted for. Revenue is where you start, and is placed at the top of the income statement, while profit is found at the bottom. So you start at revenue but end with profit.

Terms | Revenue | Profit |

Definition | Money earned from operations | Money retained after subtracting expenses from revenue |

Income statement position | Top of income statement | Bottom of income statement |

Useful for | Business projections | Capital allocation |

Affected by | Market performance | Accounting rules |

High revenue does not guarantee high profit if expenses are also high. Profit is a more precise indicator of financial health, showing how effectively a company can turn its revenue into actual earnings.

However, it is worth bearing in mind that the profit can differ depending on accounting rules, while revenue tends to remain the same. In this sense, you could say revenue is a "cleaner" figure, though still not as accurate in terms of company performance.

However, it is worth bearing in mind that the profit can differ depending on accounting rules, while revenue tends to remain the same. In this sense, you could say revenue is a "cleaner" figure, though still not as accurate in terms of company performance.

Recap of revenue vs. profit

Clearly, profit and revenue are both essential accounting terms. But it is more important to increase profit than it is to increase revenue, as profit is the bottom line and the most relevant item in any financial analysis. High revenue does not imply high profit.

However, a company can still be a good buy even with a negative profit margin for a given year. Other financial metrics could indicate a rebound is imminent, or the market could have overreacted in such a way that the price is lower than it should be, making it a sound investment.

However, a company can still be a good buy even with a negative profit margin for a given year. Other financial metrics could indicate a rebound is imminent, or the market could have overreacted in such a way that the price is lower than it should be, making it a sound investment.

FAQ on revenue vs. profit

Q: Which is more important: revenue or profit?

Both revenue and profit are crucial, but profit generally carries more weight. Revenue shows the total income from sales, but profit reflects the actual earnings after all expenses. High revenue without profit might indicate inefficiencies or high costs. In the long run, profitability ensures that a business can sustain its operations and grow.

Q: Can profit be negative if revenue is positive?

Yes, profit can be negative even if revenue is positive. This occurs when a company's expenses, including costs of goods sold, operating expenses, interest, and taxes, exceed its revenue. Negative profit, also known as a net loss, indicates that the business is spending more than it is earning.

Q: Is it better to increase revenue or profit?

Increasing profit is generally more important than just boosting revenue. While higher revenue can grow a business, profit directly impacts financial health and sustainability. Increased profit means that the business is not only generating sales but also managing its costs effectively, leading to better financial stability.

Q: How important is revenue in business planning?

Revenue is critical in business planning as it provides a basis for forecasting and budgeting. It helps in setting sales targets, planning marketing strategies, and determining operational needs. Accurate revenue projections enable businesses to allocate resources efficiently and plan for growth or address potential challenges.

Q: How important is profit in business sustainability?

Profit is essential for business sustainability. It ensures that a company can cover its expenses, invest in growth, and weather financial downturns. Sustainable profit levels indicate effective management and operational efficiency, allowing the business to reinvest in itself and maintain long-term viability.