When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Gross margin, net profit margin and operating margin: Examples and calculation formula

If you want to quickly understand how much a business makes, you needn’t look much further than gross margin, a profitability measure that compares gross profit to revenue.

Quote

“Look for companies with high-profit margins.”

Big ideas

- The higher the gross margin of a company, the more it earns per dollar spent.

- Gross margin focuses on revenue and Cost Of Goods Sold (‘COGS’). Net profit margin takes all business expenses as well as taxes into account.

- Gross margin figures vary depending on the industry, and the metric is best used in tandem with other accounting formulas.

What is the gross margin?

This figure, reported by all public companies, reveals how efficiently a company turns revenue into profit.

DEFINITION

Gross margin is the amount of revenue that exceeds the cost of goods sold (COGS), expressed as a percentage., showing how efficiently a company converts sales into profit (before considering other expenses).

COGS is a term that refers to the direct costs of producing a specific output.

Hence the difference between revenue and COGS, expressed as a percentage, is a simple way of looking at a company’s financial performance.

COGS is a term that refers to the direct costs of producing a specific output.

Hence the difference between revenue and COGS, expressed as a percentage, is a simple way of looking at a company’s financial performance.

To calculate the gross margin, we use the following formula:

FORMULA

Gross Margin = (Revenue − COGS/Revenue) × 100%

*COGS = Cost of Goods Sold

*COGS = Cost of Goods Sold

High gross margins can mean a competitive advantage. A gross margin of 60% is twice that of 30% and is clearly preferable to investors, though this is only a base indication of profitability.

Gross margin reflects pricing power, operational efficiency, and a unique product. Investors look at gross margins to assess profitability and compare against industry benchmarks.

🔼 Rising margins can be a signal of sustainable growth, as well as better management.

🔽 Declining margins can point to rising costs, poor management, or more competition in the market, so they’re something to look out for.

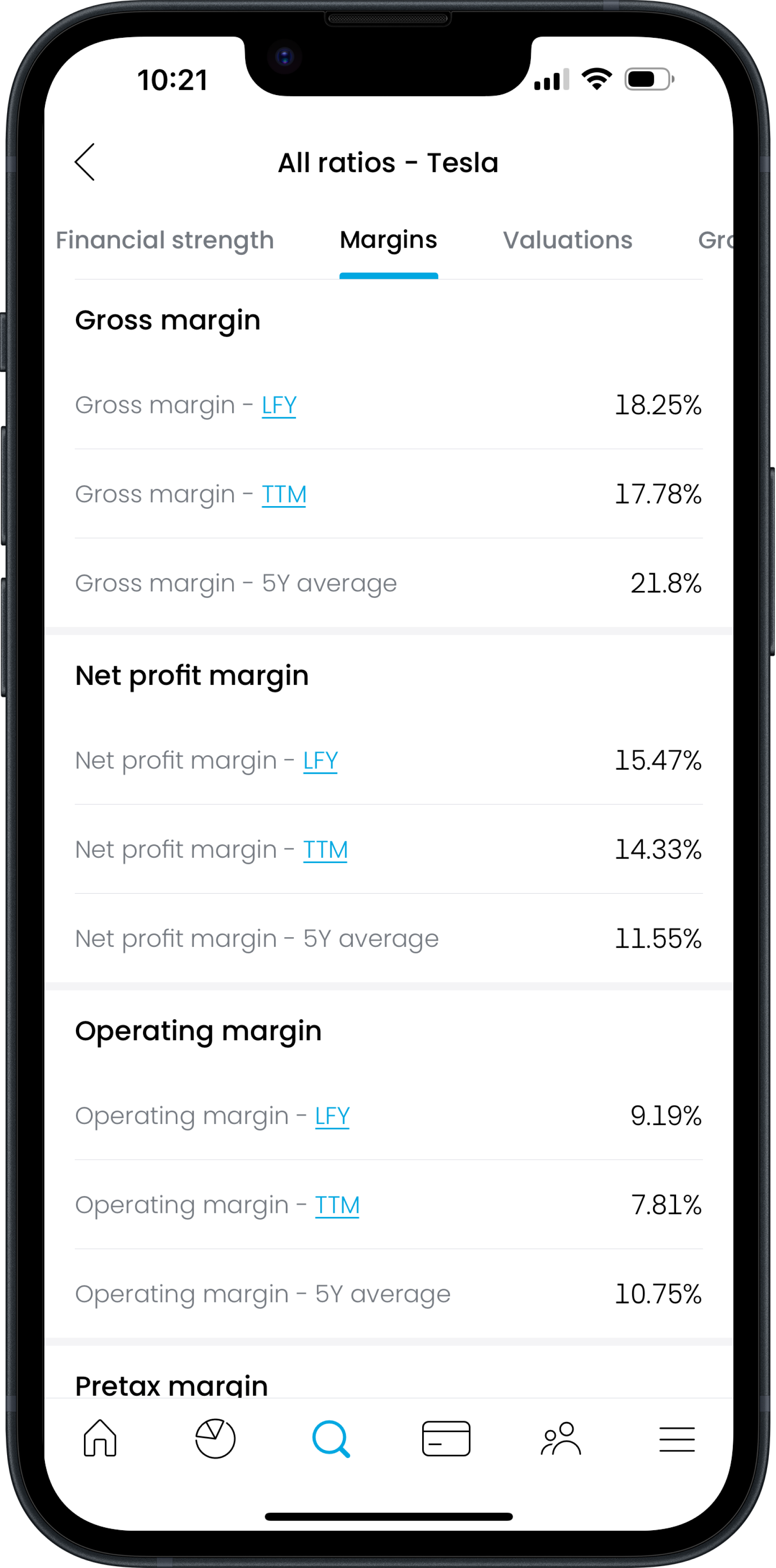

All the different types of profit margins discussed here are available for every stock, such as Tesla (TSLA) in the Trading 212 investing app.

Gross margin reflects pricing power, operational efficiency, and a unique product. Investors look at gross margins to assess profitability and compare against industry benchmarks.

🔼 Rising margins can be a signal of sustainable growth, as well as better management.

🔽 Declining margins can point to rising costs, poor management, or more competition in the market, so they’re something to look out for.

All the different types of profit margins discussed here are available for every stock, such as Tesla (TSLA) in the Trading 212 investing app.

Source: Trading 212 app

Source: Trading 212 appGross margin examples - ‘MarginSoft’

Let's consider a fictional company - MarginSoft - operating in the software industry.

In a single year, MarginSoft generates £1,000,000 in revenue from software sales. The cost of producing and delivering this software, including materials, labour, and overhead, amounts to £300,000.

We can plug the numbers into the formula above to generate an accurate margin output:

In a single year, MarginSoft generates £1,000,000 in revenue from software sales. The cost of producing and delivering this software, including materials, labour, and overhead, amounts to £300,000.

We can plug the numbers into the formula above to generate an accurate margin output:

Gross Margin = (£1,000,000 − £300,000/1,000,000) × 100% = (700,000/1,000,000) × 100% = 70%

MarginSoft's gross margin is 70%. This means that for every dollar of revenue generated, it retains seventy cents (after covering the direct costs of producing/delivering its software).

MarginSoft's gross margin is 70%. This means that for every dollar of revenue generated, it retains seventy cents (after covering the direct costs of producing/delivering its software).

Investors may view this as a healthy gross margin, as it’s quite high for a single dollar but to get a true picture of the situation, it's recommended to compare it to industry benchmarks and historical performance for additional insights.

Gross margins are industry-specific

It’s worth noting that gross margins differ depending on the industry. In the tech industry, companies like Apple (AAPL) often boast high gross margins - because of the brand strength and premium pricing. Retail sectors such as grocery stores operate on far thinner margins due to intense competition and the price sensitivity of buyers.

Understanding these nuances aids investors in assessing a company's profitability and position. A single metric is always next to useless unless understood in the context of numerous other metrics.

For example, Industries with high barriers to entry (like pharmaceuticals) typically enjoy higher margins. Those with low barriers, such as retail, often face tighter margins.

Understanding these nuances aids investors in assessing a company's profitability and position. A single metric is always next to useless unless understood in the context of numerous other metrics.

For example, Industries with high barriers to entry (like pharmaceuticals) typically enjoy higher margins. Those with low barriers, such as retail, often face tighter margins.

What is the difference between gross profit margin vs net profit margin?

DEFINITION

Net Profit Margin — this reflects the percentage of revenue that translates into profit after accounting for ALL expenses, including cost of goods sold, operating expenses, interest, taxes, and other non-operating costs.

It indicates a company's overall profitability and efficiency in managing expenses. So it goes further than gross profit margin as it takes more costs into account, giving the investor a more detailed insight.

It indicates a company's overall profitability and efficiency in managing expenses. So it goes further than gross profit margin as it takes more costs into account, giving the investor a more detailed insight.

The big distinction is that Gross profit margin measures the percentage of revenue remaining after deducting ONLY the cost of goods sold (COGS), while the more comprehensive net profit margin measures the percentage of revenue remaining after ALL expenses, including COGS, operating expenses, interest, and taxes, have been deducted.

FORMULA

Net Profit Margin = (Total Revenue/Net Profit) x 100

Example

MarginSoft generates £1,000,000 in revenue from software sales. The cost of producing and delivering this software, including materials, labour, and overhead (COGS), amounts to £300,000.

Additionally, the company incurs operating expenses of £200,000, interest expenses of £20,000, and tax expenses of £60,000. As such:

Additionally, the company incurs operating expenses of £200,000, interest expenses of £20,000, and tax expenses of £60,000. As such:

Net Profit = £1,000,000 - £300,000 - £200,000 - £20,000 - £60,000 = £420,000

Net Profit Margin =(£420,000/£1,000,000) x 100 = 42%

MarginSoft's net profit margin is 42%. This means that for every dollar of revenue generated, MarginSoft retains 42 cents after covering all its costs, including the cost of goods sold, operating expenses, interest, and taxes.

Net Profit Margin =(£420,000/£1,000,000) x 100 = 42%

MarginSoft's net profit margin is 42%. This means that for every dollar of revenue generated, MarginSoft retains 42 cents after covering all its costs, including the cost of goods sold, operating expenses, interest, and taxes.

It’s important to look at the net profit margin because costs outside of COGS could be quite large, in which case the gross margin would be misleading.

What is the difference between gross profit margin and pretax margin?

DEFINITION

Pretax margin (AKA ‘pretax profit margin’) considers all expenses incurred before taxes, including operating expenses (OPEX), interest, and depreciation.

It measures the portion of revenue remaining after deducting all expenses except taxes.

It measures the portion of revenue remaining after deducting all expenses except taxes.

The difference between gross profit margin and pretax margin is that gross profit margin measures the percentage of revenue remaining after subtracting the cost of goods sold (COGS), while pretax margin takes into account all operating expenses, interest, and other non-operating items but excludes taxes.

Essentially, gross profit margin focuses on production efficiency, whereas pretax margin provides insight into overall profitability before taxes.

Essentially, gross profit margin focuses on production efficiency, whereas pretax margin provides insight into overall profitability before taxes.

FORMULA

Pretax margin = (Earnings Before Tax/Revenue) x 100

Example

In the previous example, MarginSoft generated £1,000,000 in revenue with £300,000 in COGS - its gross margin was 70%.

EXAMPLE (part 3)

If MarginSoft has again £300,000 in COGS and also £500,000 in operating expenses and £20,000 in interest expenses, its pretax income would be £180,000, resulting in a pretax margin of 18%.

The takeaway is that the pretax margin provides a broader view of profitability, considering all expenses except taxes.

What is the difference between gross profit margin vs operating profit margin?

DEFINITION

Operating profit margin - this measures the proportion of revenue that remains after accounting for operating expenses, such as salaries, rent, and marketing costs. It gives insight into a company's profitability from its core business activities.

The difference between gross profit margin and operating profit margin is that gross profit margin looks just at profitability as far as how revenue compares with the cost of goods sold (COGS), while operating profit margin uses the broader operating expenses, encompassing COGS as well as all administrative and selling costs.

FORMULA

Operating Profit Margin = (Operating Profit/Total Revenue) × 100

Example

As we already know – MarginSoft generates £1,000,000 in revenue from software sales.

The cost of producing and delivering this software (COGS), amounts to £300,000.

Additionally, the company incurs operating expenses of £200,000:

The cost of producing and delivering this software (COGS), amounts to £300,000.

Additionally, the company incurs operating expenses of £200,000:

Operating profit (or operating income) = gross profit - operating expenses

= £700,000 - £200,000 = £500,000.

To calculate the operating margin, divide the operating profit by total revenue (£500,000 / £1,000,000), resulting in an operating margin of 50%.

This means that for every dollar of revenue, the company retains $0.50 as profit from its core operations.

= £700,000 - £200,000 = £500,000.

To calculate the operating margin, divide the operating profit by total revenue (£500,000 / £1,000,000), resulting in an operating margin of 50%.

This means that for every dollar of revenue, the company retains $0.50 as profit from its core operations.

Operating margin differs from gross margin in that gross margin focuses solely on production efficiency, while operating margin reflects profitability after accounting for all operating expenses. It goes a little further than gross margin, the most basic metric from a financial perspective.

Recap

Gross margin is a simple but important business term to understand. It offers a quick and neat overview of a company's profitability based on revenue and cost of goods sold. The higher the margin, the better, though you will have to be careful to take the industry sector into account and use it in tandem with other accounting information.

You can build on gross margin by including operating margin, net margin, and pretax margin. Together, these four metrics will provide a precise understanding of the company’s financial position in conjunction with other data.

You can build on gross margin by including operating margin, net margin, and pretax margin. Together, these four metrics will provide a precise understanding of the company’s financial position in conjunction with other data.

FAQ

Q: What Is gross margin?

Gross margin represents the percentage of revenue that exceeds the cost of goods sold - COGS. It's calculated by subtracting COGS from total revenue and then dividing the result by total revenue. It measures how efficiently a company produces its goods or services before factoring in other expenses.

Q: Why is gross margin important?

Gross margin is crucial as it indicates a company's ability to generate profit from its core operations. It provides insights into the efficiency of production processes and pricing strategies.

High gross margins generally signify strong profitability potential, while declining margins might indicate pricing pressure or increasing production costs, prompting the need for strategic adjustments.

High gross margins generally signify strong profitability potential, while declining margins might indicate pricing pressure or increasing production costs, prompting the need for strategic adjustments.

Q: What’s the difference between gross margin and gross profit margin?

Gross margin and gross profit margin are often used interchangeably, but they differ in their meaning and calculations. While both gross margin and gross profit margin measure a company's profitability from its core operations, gross profit margin specifically focuses on the relationship between gross profit and total revenue, excluding other operating expenses.

Q: What are some low and high-profit margin industries?

Low-profit margin industries typically include retail, grocery, and food service, where competition is high, and margins are often razor-thin due to pricing pressures.

High-profit margin industries encompass technology, pharmaceuticals, and luxury goods. These are typified by unique products or services, strong brand loyalty, and the ability to command premium prices.

High-profit margin industries encompass technology, pharmaceuticals, and luxury goods. These are typified by unique products or services, strong brand loyalty, and the ability to command premium prices.

Q: What are some other examples of margin aside from gross margin?

Other types of margins include operating margin, net profit margin, and contribution margin. Operating margin measures a company's operating efficiency by comparing operating income to revenue.

Net profit margin, on the other hand, assesses overall profitability by comparing net income to revenue. The contribution margin represents the portion of sales revenue that exceeds variable costs and contributes to covering fixed costs.

Net profit margin, on the other hand, assesses overall profitability by comparing net income to revenue. The contribution margin represents the portion of sales revenue that exceeds variable costs and contributes to covering fixed costs.

Q: What Is the difference between gross margin and pretax profit margin?

Gross margin focuses solely on the relationship between revenue and the cost of goods sold, whereas pretax profit margin considers all expenses incurred before taxes, including operating expenses, interest, and depreciation.

Essentially, the pretax profit margin provides a broader view of a company's profitability, factoring in all costs, not just those directly associated with production.

Essentially, the pretax profit margin provides a broader view of a company's profitability, factoring in all costs, not just those directly associated with production.

Q: How can companies improve their net profit margin?

Companies can boost net profit margins in much the same way they would go about increasing overall profitability - cutting costs, raising prices wisely, growing revenue, using technology to work smarter, managing debt wisely, reducing taxes, focusing on high-margin products, and keeping a close eye on finances.

These steps help ensure that more revenue translates into profit after all expenses are covered. Obviously, this is a high-level overview, and there is much nuance in a given industry.

These steps help ensure that more revenue translates into profit after all expenses are covered. Obviously, this is a high-level overview, and there is much nuance in a given industry.