When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

The Revolutionary 212 Card

No FX fee, true interbank rate, no spread markup

Zero

FX fee, true interbank rate

0.5%

cashback on your spending

8.2%

AER on your pounds

13

major currencies

Free

No monthly subscription

Interest applies on cash in an investment account. Terms apply. ATM withdrawals are free up to £400 per month, 1% ATM fee applies thereafter.

Spend with the ultimate travel card

No FX fee, true interbank rate, no spread markup

0% FX fee applies to all 212 card transactions. 0.15% FX fee applies when you convert funds in the app.

Last update 22:15 UTC.

We do not include accounts with limited availability due to eligibility requirements, such as high minimum balance, high annual income, etc.

FX exchange is offered only in the context of Trading 212's investment services. Comparisons to other service providers are made by Trading 212 and are based on published rates on their websites. Learn how we collect this data.

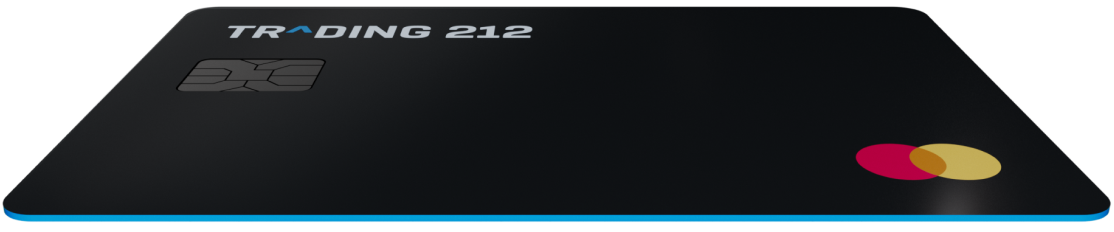

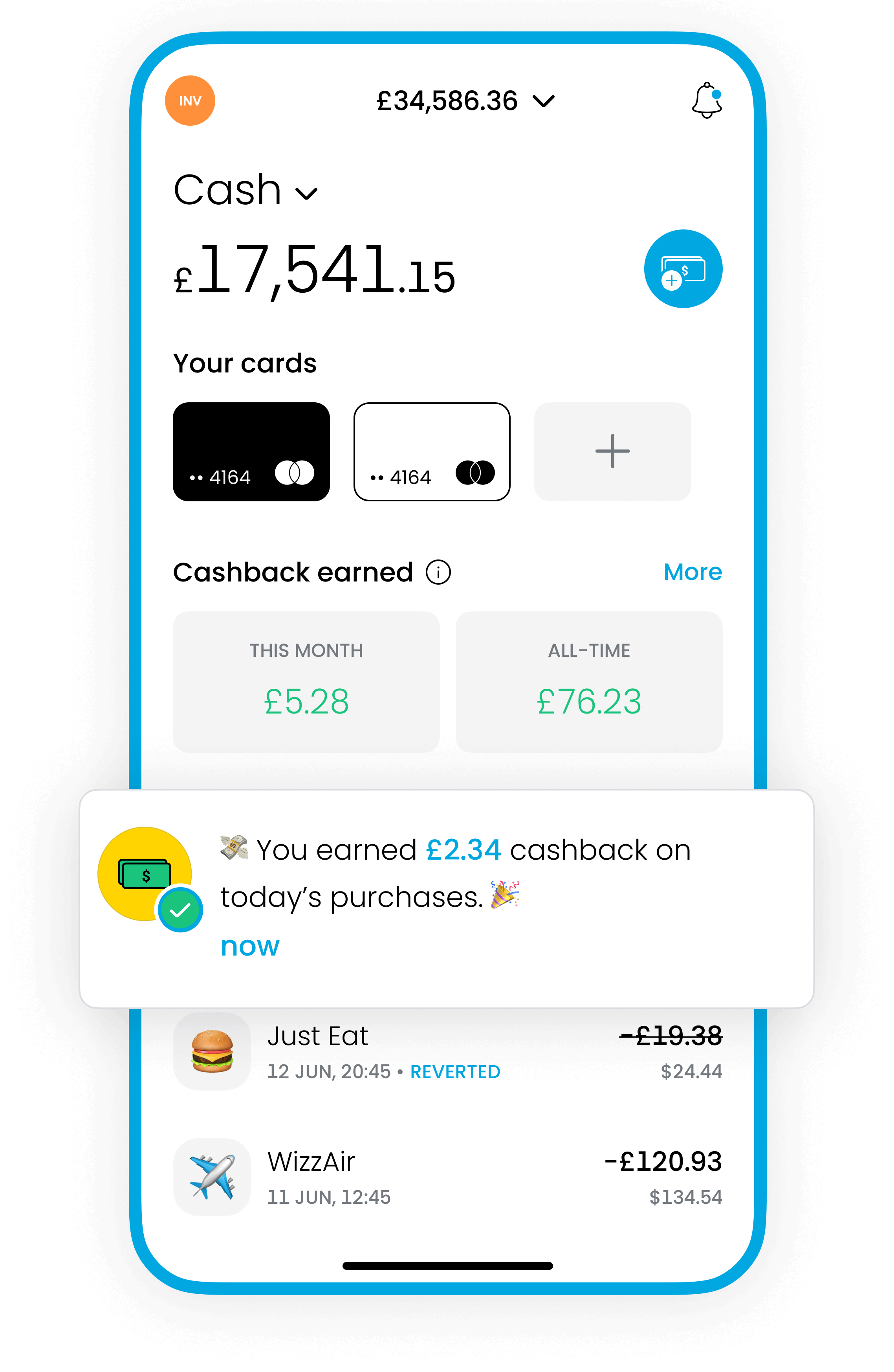

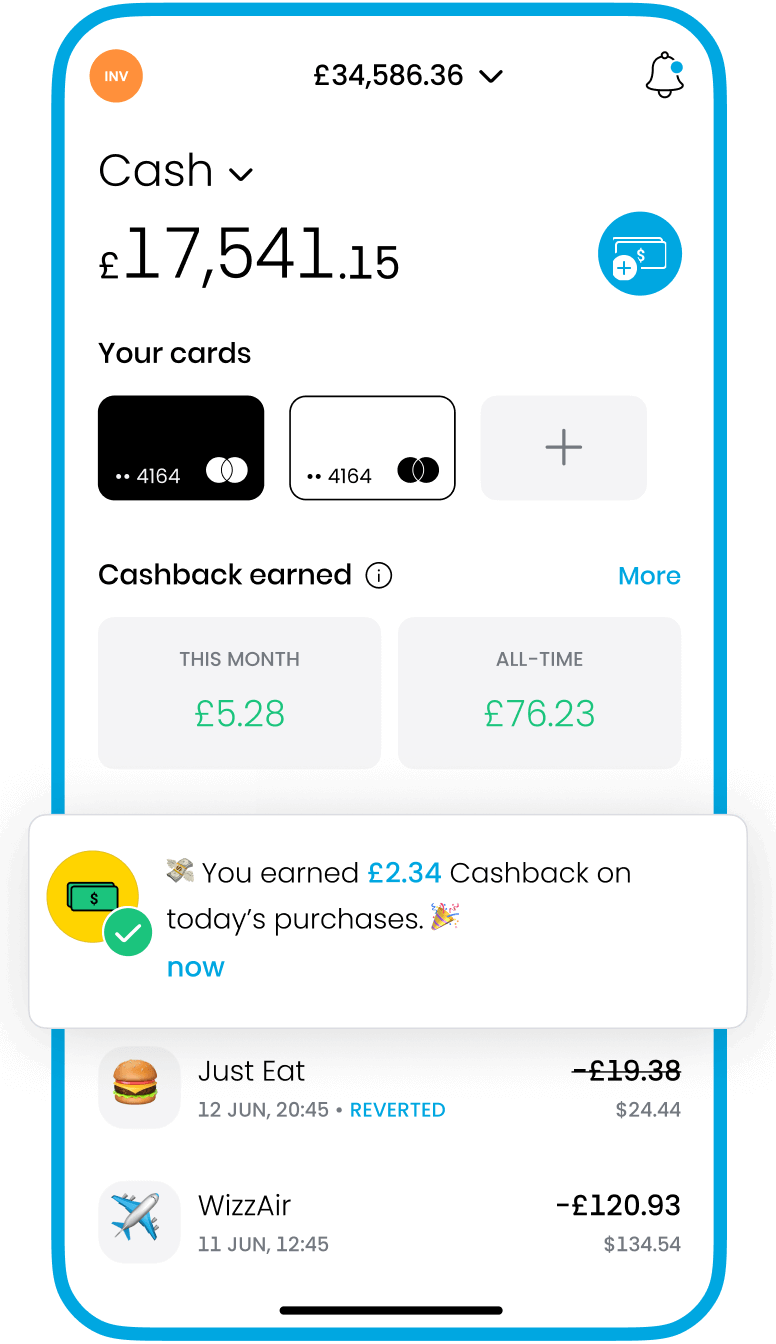

0.5% cashback on your purchases

Get up to £20 per month back on your spending

See our Cashback Terms

Multi-currency account

Earn high interest on 13 currencies

No subscription fee

Our card is free - no sneaky fees or plans. See the difference.

Standard

Standard

Current

Subscription fee

£0

£0

£0

£0

£0

FX fee

0%

1%

after the free exchange limit of £1,000 per mo. is exceeded

From 0.42%

Fee varies by currency

0%

0%

FX rate

True interbank

No mark-up

Custom “Revolut” rate

Interbank + variable mark-up

Mid-market

Mastercard rate

Mid-market + 0.75%

Mastercard rate

Mid-market + 0.75%

Weekend FX fee

None

1%

None

None

None

ATM withdrawal fees

Free up to £400

per month

1% thereafter

Free up to £200 per month

2% thereafter

Free up to £200

per month

1.75% + £0.50 per withdrawal thereafter

Free up to £400

per month

3% thereafter (0%, if Monzo is your main bank)

Free

Withdrawals capped at £500 a day

Interest on GBP cash

8.2% AER

on uninvested cash

2.29% AER

3.31% AER

4.10% AER

Capped at £100,000

1.00% AER

Cashback

0.5%

Capped at £20 per month

0%

0%

2-10%

applies on transactions with partner retailers only

1%

only if £500 was deposited for the month. Capped at £15 per month.

Comparisons to other service providers are made by Trading 212 and are based on published costs on their websites as of 12 February 2024.

One time cost applies when ordering physical card. Issuing a virtual card is free.

Move money instantly between

saving, investing, and spending

212 cards are issued by Paynetics UK Ltd., a UK payment services provider. Trading 212 provides you with the user interface and full customer support. Paynetics UK Ltd provides all card-related payment services. If you enable interest, we will hold your cash in qualifying money market funds and banks. Otherwise, we will hold it only in banks. Interest applies on cash in an investment account. Terms apply. When investing, your capital is at risk. Other fees may apply.

Pay fast and easy in shops, in apps, and online with Apple Pay.

Frequently asked questions

What rate do I get from Trading 212?

You always get the live interbank rate with no additional spreads or markups.

If you're converting during the weekend, you get the last available interbank rate from the weekday, as there is no live interbank rate during the weekend.

In case we don't have an interbank rate, we'll use Mastercard's exchange rate without adding additional spreads or markup.

What is the interbank rate?

The interbank rate is the rate at which banks exchange currencies with each other. This rate is not a single rate but rather a range defined by the buy and sell prices.

The sell price is the highest price a buyer is willing to pay for a currency, and the buy price is the lowest price at which a seller is willing to sell. The difference between these two prices is known as the spread.

For example, if EUR/USD's current buy and sell prices are 1.07700 / 1.07750, that is the interbank rate range.

The interbank rate for buying USD with EUR is 1.07750.

The interbank rate for selling EUR for USD is 1.07700.

What is the mid-market rate?

The mid-market rate is the midpoint between the buy and sell prices of the currencies on the global currency markets.

For example, if EUR/USD's current buy and sell prices are 1.07700 / 1.07750, mid-market rate is 1.07725, the value that's in the middle of 1.07700 / 1.07750.

The same rate of 1.07725 will apply whether you're buying or selling.

What is the difference between interbank rate and mid-market rate?

Тhe difference between the interbank rate and the mid-market rate is the position within the buy and sell price range.

The interbank rate varies depending on if you are buying or selling currency - it's the specific rate you get at that moment.

The mid-market rate is the average of the buy and sell rates and is the same whether you are buying or selling. It's like the halfway point between what buyers are willing to pay and what sellers are willing to accept.