When investing, your capital is at risk and you may get back less than invested. Past performance doesn’t guarantee future results.

Volatility trading guide: Causes, key influencing factors and indicators & volatility trading instruments

Do you see volatility as a threat or an opportunity?

This guide will show you how to interpret volatility, and practical strategies to protect yourself and take advantage of the opportunities it brings.

This guide will show you how to interpret volatility, and practical strategies to protect yourself and take advantage of the opportunities it brings.

QUOTE

“In the world of investing, volatility is like the weather: unpredictable but with patterns worth understanding."

Big ideas

- Opening and closing times of stock exchanges see heightened trading activity and volatility, offering unique trading windows.

- Implied volatility signals market expectations and sentiment, serving as a predictive tool for market trends.

- Volatility clustering suggests market movements are not random but follow patterns of calm and turbulence.

What is volatility?

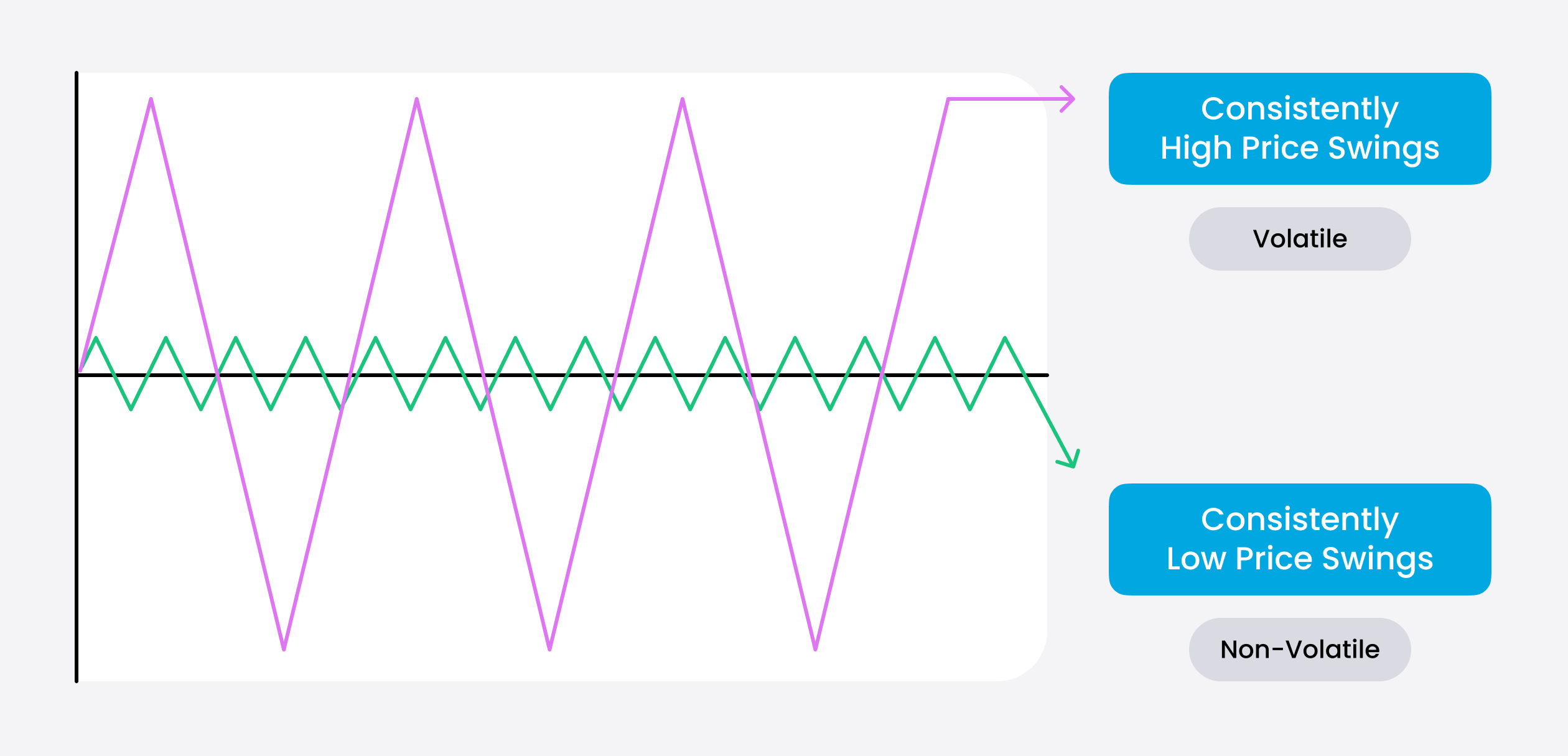

Volatility, a term often bandied about in financial circles, essentially measures the depth or shallowness of the swings in asset prices within certain timeframes.

DEFINITION

Volatility refers to the degree of variation in the price of a security, market index, or asset over a specific period.

It is often measured using statistical metrics like standard deviation or variance between returns from that same security or market index.

It is often measured using statistical metrics like standard deviation or variance between returns from that same security or market index.

Think of it as a measure of the price movement's pace and magnitude, where a high volatility indicates significant price changes over a short period, and a low volatility denotes minor price shifts.

The main causes of market volatility

Many factors make the financial markets volatile. For example, geopolitical tensions are unsettling for traders, and shock changes to economic data like inflation rates and job figures, as well as corporate earnings surprises, all play a key role in this. If some new data deviates from expectations, it will often have a pronounced effect on some market prices, creating higher volatility than usual.

1. The impact of news on volatility

News can be a turning point for financial markets. Major events such as political announcements, societal unrest or corporate misconduct almost always lead to instant and, at times, dramatic reactions in various markets.

News provides additional information that can quickly change investor sentiment, thus prompting higher levels of trading activity.

News that affect markets tend to fit into one of these categories:

- Macroeconomic

- Geopolitical

- Corporate

Political instability, elections, conflicts, or geopolitical tensions can create uncertainty in the markets. For example, wars, trade disputes or sanctions between major economies can disrupt global supply chains and impact international investments, leading to volatility.

Company-specific news, such as earnings releases, management changes etc., could impact its share price significantly. These events may change investors’ perception regarding the future prospects for a given company hence increased buying or selling pressure.

Volatility during earnings season is particularly noteworthy since companies release their financial performance for the previous quarter, and investors pay very close attention to this, companies can see their stock prices rise if they exceed consensus estimates and fall if they fail to meet them.

Company-specific news, such as earnings releases, management changes etc., could impact its share price significantly. These events may change investors’ perception regarding the future prospects for a given company hence increased buying or selling pressure.

Volatility during earnings season is particularly noteworthy since companies release their financial performance for the previous quarter, and investors pay very close attention to this, companies can see their stock prices rise if they exceed consensus estimates and fall if they fail to meet them.

2. Economic releases and the effect on volatility

The state of the economy is an important determinant of stock market volatility. From GDP growth numbers to central bank interest rate decisions; regular economic updates are followed closely by investors and institutions. These represent economic health assessments that guide investment plans made by individuals. Unexpected results usually make traders reassess positions on new information, causing fluctuation in market prices.

Whilst having the most direct impact on the forex or commodities markets, economic releases still affect companies in major ways.

Whilst having the most direct impact on the forex or commodities markets, economic releases still affect companies in major ways.

EXAMPLE

If the US were to raise their interest rates:

👉 Then it may make an investment in a US company such as Meta Platforms (META) or Apple (AAPL) less attractive.

👉 These companies won’t be able to invest as much in new technologies and growth due to the economic environment in the country they are operating within.

👉 Raising US interest rates could also affect the dollar, affecting the returns for foreign investors using multi-currency accounts.

👉 Then it may make an investment in a US company such as Meta Platforms (META) or Apple (AAPL) less attractive.

👉 These companies won’t be able to invest as much in new technologies and growth due to the economic environment in the country they are operating within.

👉 Raising US interest rates could also affect the dollar, affecting the returns for foreign investors using multi-currency accounts.

An economic calendar is a useful way to prepare for potential market volatility caused by upcoming data releases.

Source: Trading 212 web app

Source: Trading 212 web app3. Analyst opinions affect on volatility

Financial analysts have a lot of clout in terms of what they say about the market or which stocks to buy. A good rating or upgrade can make a stock soar, while a downgrade will cause big sell-offs, thus contributing to market volatility.

EXAMPLE

Before analyst action:

Imagine a company, "Tech Innovate Inc.", whose stock has been performing steadily without much volatility.

Analyst upgrade:

An esteemed analyst upgrades Tech Innovate from "Hold" to "Buy," citing innovative product launches and strong market potential.

Market reaction:

Following the upgrade, Tech Innovate's stock price jumps significantly as investors rush to buy shares to benefit from what the analyst has forecast.

Imagine a company, "Tech Innovate Inc.", whose stock has been performing steadily without much volatility.

Analyst upgrade:

An esteemed analyst upgrades Tech Innovate from "Hold" to "Buy," citing innovative product launches and strong market potential.

Market reaction:

Following the upgrade, Tech Innovate's stock price jumps significantly as investors rush to buy shares to benefit from what the analyst has forecast.

You can learn more about the effects of analyst notes, like a stock outperform rating, in our full guide on the subject.

4. Market regulation and volatility

Regulations are put in place for financial markets’ integrity. These rules aim at preventing the occurrence of undue volatility that may be brought about by manipulations of the market and uncontrolled speculation.

For instance, circuit breakers –which temporarily halt trading in case prices fall rapidly- help maintain orderly trading environments. These are usually set at increments of 10% but are chosen by national market regulators.

For instance, circuit breakers –which temporarily halt trading in case prices fall rapidly- help maintain orderly trading environments. These are usually set at increments of 10% but are chosen by national market regulators.

Regulatory measures for controlling volatility

Various measures are put in place by The Financial Conduct Authority (FCA) in the UK as well as other global regulatory bodies to prevent market volatility.

These include transparency mandates, which ensure that investors have access to all relevant information concerning markets, and rules against market abuse that protects customers from being treated unfairly.

These include transparency mandates, which ensure that investors have access to all relevant information concerning markets, and rules against market abuse that protects customers from being treated unfairly.

5. Market Liquidity

Liquidity refers to the ease with which assets can be bought or sold in the market without affecting their price.

Markets with high liquidity tend to have less volatility since trades can be executed quickly and efficiently. In contrast, low liquidity can lead to more pronounced price movements as each trade has a greater impact on the market price.

There is also a chicken and the egg relationship between liquidity and volatility, whereby liquidity can also be driven by volatility. For example, investors exiting the market during a period of panic or because of a lack of opportunities caused by flat price action.

Markets with high liquidity tend to have less volatility since trades can be executed quickly and efficiently. In contrast, low liquidity can lead to more pronounced price movements as each trade has a greater impact on the market price.

There is also a chicken and the egg relationship between liquidity and volatility, whereby liquidity can also be driven by volatility. For example, investors exiting the market during a period of panic or because of a lack of opportunities caused by flat price action.

6. Leverage

The use of borrowed funds to increase trading positions can amplify gains but also losses, leading to greater volatility. When market participants use high leverage, even small price movements can lead to large changes in account balances, prompting swift reactions that can increase market volatility.

Derivatives such as options, futures, and swaps allow traders to speculate on or hedge against future price movements. The leverage inherent in these instruments can magnify market movements, contributing to volatility. Additionally, the complexity and interconnectedness of these instruments can lead to unforeseen consequences in times of stress.

Derivatives such as options, futures, and swaps allow traders to speculate on or hedge against future price movements. The leverage inherent in these instruments can magnify market movements, contributing to volatility. Additionally, the complexity and interconnectedness of these instruments can lead to unforeseen consequences in times of stress.

7. Algorithmic and High-Frequency Trading

Algorithms that execute trades based on pre-set criteria can lead to sudden spikes in volatility. High-frequency trading, which involves executing a large number of orders at very fast speeds, can exacerbate price movements, especially during turbulent market conditions.

The 1987 Stock Market Crash

The 1987 crash, known as "Black Monday," saw the Dow Jones Industrial Average (DJIA) drop by 22.6% in a single day.

Portfolio insurance involved computer models to execute dynamic hedging strategies, selling stock futures as markets declined to limit losses.**

This automated selling, however, contributed to the downward spiral on October 19, 1987, as the models triggered more sell orders in response to falling prices, exacerbating the crash.

Portfolio insurance involved computer models to execute dynamic hedging strategies, selling stock futures as markets declined to limit losses.**

This automated selling, however, contributed to the downward spiral on October 19, 1987, as the models triggered more sell orders in response to falling prices, exacerbating the crash.

Volatility trading instruments

For those looking to engage with volatile markets, several instruments are at their disposal.

Exchange-Traded Funds (ETFs)

ETFs focusing on sectors or assets with higher volatility provide an alternative way of participating in price movements without holding such underlying securities directly. They are also known for their high liquidity and ease of trading.

Leveraged and inverse volatility products

On the other hand, leveraged products and inverse ones are meant for experienced traders looking to earn more money with amplified returns or betting against the direction taken by the market; however, they have higher risk levels than some other forms meaning only very experienced traders and investors can gain access to them.

Leveraged volatility products examples

ProShares Ultra VIX Short-Term Futures ETF (UVXY): This is a 1.5x leveraged ETF that aims to provide returns that are 1.5 times the daily performance of the S&P 500 VIX Short-Term Futures Index.

VelocityShares Daily 2x VIX Short-Term ETN (TVIX): This product seeks to offer 2 times the daily performance of the S&P 500 VIX Short-Term Futures Index.

VelocityShares Daily 2x VIX Short-Term ETN (TVIX): This product seeks to offer 2 times the daily performance of the S&P 500 VIX Short-Term Futures Index.

TVIX was delisted in 2020, demonstrating just how much risk and volatility can be associated with these types of products.

Inverse volatility products examples

ProShares Short VIX Short-Term Futures ETF (SVXY): This ETF looks to give an opposite exposure to the S&P 500 VIX Short-Term Futures Index as a way of betting against rising market volatility.

VelocityShares Daily Inverse VIX Short-Term ETN (XIV): Similar to SVXY, XIV aimed at providing a short exposure on the VIX Short-Term Futures Index.

After an enormous volatility event hit XIV in February of that year, causing an abrupt loss in its value by up to eighty percent within one day; it was delisted from markets. Credit Suisse who was responsible for issuance terminated this product suddenly, thereby leaving many investors counting losses amounting to millions of dollars.

VelocityShares Daily Inverse VIX Short-Term ETN (XIV): Similar to SVXY, XIV aimed at providing a short exposure on the VIX Short-Term Futures Index.

After an enormous volatility event hit XIV in February of that year, causing an abrupt loss in its value by up to eighty percent within one day; it was delisted from markets. Credit Suisse who was responsible for issuance terminated this product suddenly, thereby leaving many investors counting losses amounting to millions of dollars.

Complex financial instruments such as leveraged and inverse volatility products have high levels of risks, including substantial capital losses, especially during periods of volatile market conditions and are not appropriate for all users since most are built for short-term trading strategies.

Types of traders that use volatility

Day traders in volatility

Retail traders thrive on volatility, attempting to profit from small price changes by increasing leverage, trading on shorter time-frames and relying on volatility.

When confronted with such risky markets, day traders usually rely on technical analysis combined with various market indicators such as moving averages, RSI, chart patterns and candlestick charts while making trades.

When confronted with such risky markets, day traders usually rely on technical analysis combined with various market indicators such as moving averages, RSI, chart patterns and candlestick charts while making trades.

The impact of short-sellers on volatility

Short sellers who make money by anticipating the fall in stock prices can cause volatility. They are capable of putting downward pressure on stock prices with their trading actions, which consequently cause an increase in market fluctuation, as seen in the Gamestop saga of 2021.

High-frequency trading firms in volatility

High-frequency trading (HFT) firms use algorithms to execute trades at lightning speeds, often capitalising on minute price discrepancies. While they provide liquidity, their rapid trading strategies can also contribute to sudden market movements.

Trading strategies for volatile markets

In volatile markets, adopting a strategy grounded in probability and risk management can provide a steadying influence.

Strategy Type | Strategy Name | Description |

Volatility Arbitrage | VIX Futures Arbitrage | Exploits differences between VIX spot and futures prices, based on historical and probabilistic assessments of future movements. |

Statistical Arbitrage | Statistical Arbitrage | Uses quantitative models to identify price discrepancies between correlated assets, betting on reversion to mean based on calculated probabilities. |

Mean Reversion | Bollinger Bands | Buys or sells based on the asset's position within Bollinger Bands, anticipating reversion to the mean. |

Mean Reversion | Pair Trading | Identifies and trades on the deviation from the historical correlation of two securities, expecting reversion to their mean relationship. |

Momentum Trading | Moving Average Crossover | Trades on the crossover of short-term and long-term MAs, predicting continued movement in the direction of the crossover based on historical probabilities. |

Event-Driven | Earnings Releases | Analyses stock performance around earnings announcements to predict direction post-earnings, often employing options to profit from anticipated volatility. |

Hedging strategies for volatile markets

Hedging is a strategy used to offset potential losses in investments by taking an opposite position in a related asset. This is often achieved through the use of derivatives, such as options and futures contracts. When the market becomes volatile, hedging can act as a financial safeguard, offering protection against downside risk.

EXAMPLE

An investor owning a stock portfolio could buy put options on those stocks too.

In case there is a decrease in stock prices, then the put options reduce the amounts lost in the portfolio. If prices keep on rising concerning the shares acquired, then this option expires.

In case there is a decrease in stock prices, then the put options reduce the amounts lost in the portfolio. If prices keep on rising concerning the shares acquired, then this option expires.

Hedging is, however, not a perfect solution, and it also has some limitations. First, hedging requires an upfront cost, i.e. the premium paid for options contracts which may erode overall investment returns. Furthermore, hedging strategies can be intricate, requiring precise timing and execution to be effective.

The risk of over-hedging also exists, whereby the cost of the hedge outweighs its benefits, thereby leading to unnecessary expenses that could erode profits.

The risk of over-hedging also exists, whereby the cost of the hedge outweighs its benefits, thereby leading to unnecessary expenses that could erode profits.

Risk management strategies for volatile markets

Prudent risk management in volatile markets is key. Methods include; setting clear stop-loss orders so as to prevent significant losses, diversifying across asset classes in order to spread risk and adhering to disciplined investment approaches that avoid emotional decisions in trading activity.

Investors have various strategies for adjusting their risk management tactics due to market volatility:

Investors have various strategies for adjusting their risk management tactics due to market volatility:

- Average True Range (ATR): Modify stop loss size using ATR of the asset, thus putting up wider stops on more volatile conditions.

- Volatility Percentage Scaling: Adjust position sizes based on the asset’s volatility as a percentage of price. This means smaller positions at more volatile markets, thus keeping risk consistent.

- Beta Adjustment: Assets with higher beta are likely to have lower positions hence taking into account the sensitivity of an asset towards market movements, with higher beta ones having smaller positions due to high volatility.

- Implied Volatility (IV) in Options: Use IV from options markets to forecast future volatility in the underlying assets and adjust position sizes or stop losses, especially where there are high price movements expected.

- Volatility Bands (e.g. Bollinger Bands): A way to allow trades more room to move according to the past volatility (usually 20 days). The bands consider the price fluctuations over that time. In volatile markets, you can set stop losses just beyond these bands.

Trading psychology in volatile markets

The psychological aspect of trading cannot be overemphasised. When a market is in a volatile state, keeping calm and adhering to a well-thought-out trading plan becomes critical. Making impulsive decisions can often lead to panic or greed, which may jeopardise long-term success.

Recap

Understanding and adapting to market volatility requires a blend of knowledge, strategy, and temperament. By staying informed and disciplined, traders can navigate volatile and turbulent waters with greater confidence and poise, turning potential challenges into opportunities.

FAQ

Q: What are the four types of volatility?

Historical Volatility, Implied Volatility, Future / Expected Volatility, and Realised Volatility are the four major types in general terms.

The historical measure data helps in evaluating past price changes, while the implied indicates estimates made by markets regarding future outcomes, the future volatility predicts likely behaviour in coming days, whereas the realised one provides actual past price fluctuation information.

The historical measure data helps in evaluating past price changes, while the implied indicates estimates made by markets regarding future outcomes, the future volatility predicts likely behaviour in coming days, whereas the realised one provides actual past price fluctuation information.

Q: How do you trade volatility successfully?

When it comes to successful volatility trades, keep these principles in mind:

1. Develop a clear and tested trading strategy that aligns with your risk tolerance.

2. Practise effective risk management by using stop-loss points and managing position sizes.

3. Be aware of market events as well as economic indicators that may affect volatility.

4. Exercise discipline and emotional control, like avoiding snap decisions during times of market turbulence.

1. Develop a clear and tested trading strategy that aligns with your risk tolerance.

2. Practise effective risk management by using stop-loss points and managing position sizes.

3. Be aware of market events as well as economic indicators that may affect volatility.

4. Exercise discipline and emotional control, like avoiding snap decisions during times of market turbulence.

Q: Which volatility is best to trade?

The best form of volatility one can trade depends on the risk appetite and style used by the trader. While some traders prefer options based on implied volatility, others focus on historical or realised volatility of the underlying assets.

It is crucial to select an approach that suits your strategy and goals.

It is crucial to select an approach that suits your strategy and goals.

Q: Is trading volatility profitable?

Experienced traders who know how to navigate its intricacies can make money through this type of trading. However, it is vital to mention that this also comes with greater risks as not all traders will always find it suits their style and knowledge base.

Successful trades therefore necessitate robust planning, risk assessment measures as well as awareness about the different principles applied by markets.

Successful trades therefore necessitate robust planning, risk assessment measures as well as awareness about the different principles applied by markets.